COMMISSION FOR FINANCIAL CAPABILITY

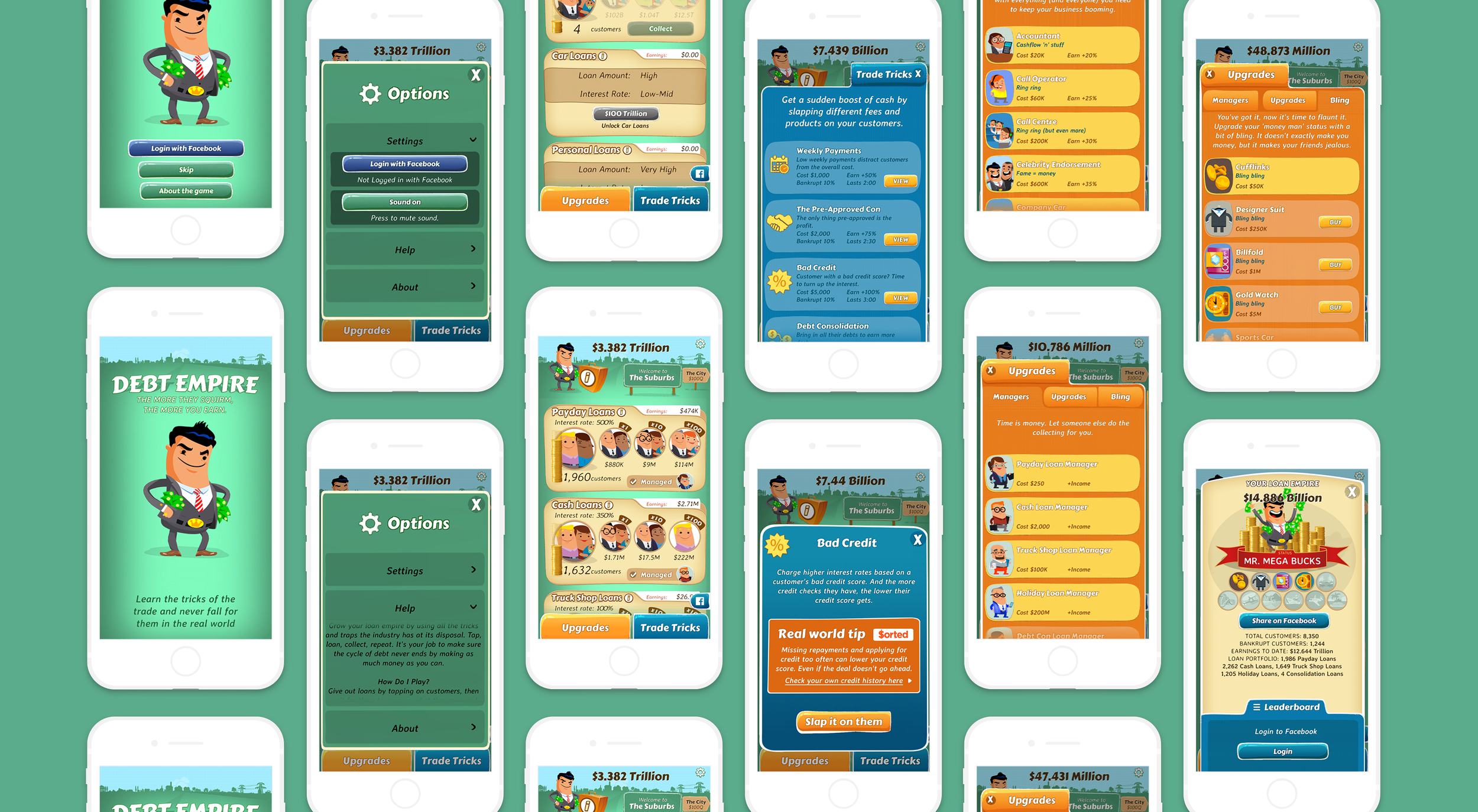

Debt Empire

Helping New Zealand youth deal with the dangers of debt.

The Commission For Financial Capability, wanted to reach young audiences for whom debt was increasingly becoming normalised in their every day life.

Our idea? Hide the tools for mastering debt inside an addictively clickable game. Kids build a Debt Empire by being loan sharks - teaching them the tricks of the trade so they never fall for them in the real world.

The Process

We chose a clicker style game which plays on repetitive bursts of interactions, then worked with Rush Digital to define the specific game mechanicas that would create the desired learning behaviours. This drove home the different evil tricks that loan companies would use, over and over again, whilst keeping it fun and addictive.

Concepting and wireframing game meachanics.

Messaging and behaviour mapping.

Initial character design.

The Solution

Debt Empire mechanics are designed to teach players the ins and outs of the debt trade by putting them on the other side of the equation.

Players take on the role of an unscrupulous loan shark and attempt to grow their empire by peddling debt loaded with sneaky terms and conditions, slapping customers with hidden fees and making them bankrupt. All the while being armed with the tricks of the trade and shifting their basic perceptions around bad debt.

The game uses a virtual economy through which players add customers, open new lending portfolios, hire people to collect their money and slap customers with ridiculous fees and interest rates. A leader board lets them share their progress and compete against their Facebook community.

Debt Empire users averaged over an hour of time in game.

After the success of its launch, the app was made available as a tool in the New Zealand curriculum, putting it in the hands of over 400,000 school children - ultimately helping to break the cycle of debt.